“Interesting” is the last word that you usually want to hear in a business context – especially when it stands alone. You have slaved over PowerPoints, demonstrations, use cases, discussion outlines, business arguments or models, and upon presentation the audience feedback is “that is interesting”. “Interesting” means that you missed the mark.

That is “interesting”.

Translated, though polite, it means:

- Not ready for prime time.

- I have too much information to digest, and I can’t process something complicated right now.

- We are curious, but not curious enough to act.

- We don’t truly understand. What does it mean to me?

- We would have to change our belief system to accept your premise.

- We would have to change our behaviors to accept your premise or product and we just don’t accept change unless others do so first.

- It seems complicated and we just don’t have time to fully learn what you are trying to get us to do.

- You might be right, but so what?

- It is not strategic for us at this moment.

- Nor would it be a priority, if true.

- We appreciate the education.

Of course, you would not want to be “uninteresting”. So, there is perhaps some hope. But by and large, hearing the word “interesting’ represents the termination or indefinite pause of almost any further communication, discussion, or investment.

And for you, the smart course of action might be disinvestment. Cut your losses and move on. Kiss some more frogs. But if you are inclined to move an audience forward, there are ways.

Getting from “Interesting” to “Compelling“.

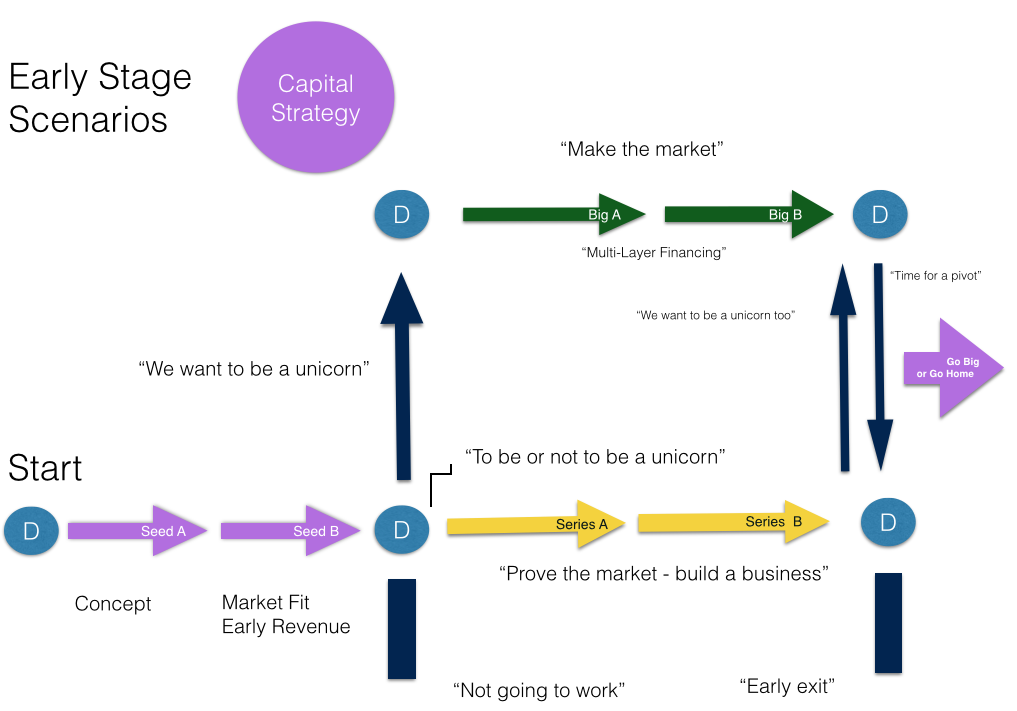

The goal should be to move your audience from “interesting” to “compelling” which is the step before being “actionable”; or said another way, from “interesting” to “That is interesting, and I would like to learn more”.

One way to achieve a response of “compelling” is to make your proposition or product relatable. How would the proposition or product affect your prospective customer, partner or funder, specifically? How much have you been able to qualify their needs or strategic direction? Have you listened well? You want to hear “I can see how this might help X,Y, Z strategy” or “it could help meet one of our customer’s needs.”

Conversely, one of the attributes that makes presentations fall into the “interesting” bucket is a lack of a shown relationship to the immediate needs of a prospective customer, partner, funding source, etc., This most often happens when your team takes a “transactional” approach to communication and sells a “thing” rather than making a connection and building trust through relationships.

It is never enough to ask an audience to recognize your brilliance, invention, or innovation. You must make the connection of trust. In other words, you at a minimum want to drive a reaction of:

“You know, that was interesting, it did not quite hit the mark, but we can see how with our help, we could create value together. We also believe that they are knowledgeable enough to work with. And they also appear to be good listeners and fun to work with as well. They appear to be experienced, competent businesspersons and show cohesive teamwork.”

When you hear the response of “interesting” that means that it sparks some curiosity – even if fleeting. So, the best strategy – feed the curiosity engine. Let them explore. Let them experience and make it easy. Let them relate to your ideas and/or products. And let them get to know you. Listen to the audience. For being heard is the most powerful emotion in the World.

Changing the Paradigm

The most common condition for the “That is interesting” response is when you are trying to change a paradigm, or you are advocating a different, “better” way of doing things that requires change. Your proposed change can be “better, faster, cheaper” even disruptively so. But paradigm shifting, by its nature is a heavy lift.

We see this in the Water industry often in bringing new world technologies and Water Intelligence to an industry built on predictability, that is project centric, and built with manual processes. But that is true in many industries. Just know your challenge and prepare accordingly.

We all want to be interesting. But better to be interesting, effective, and engaged.